Three Arrows Capital creditors lent bankrupt fund $3.5 billion, court documents show

Quick Take

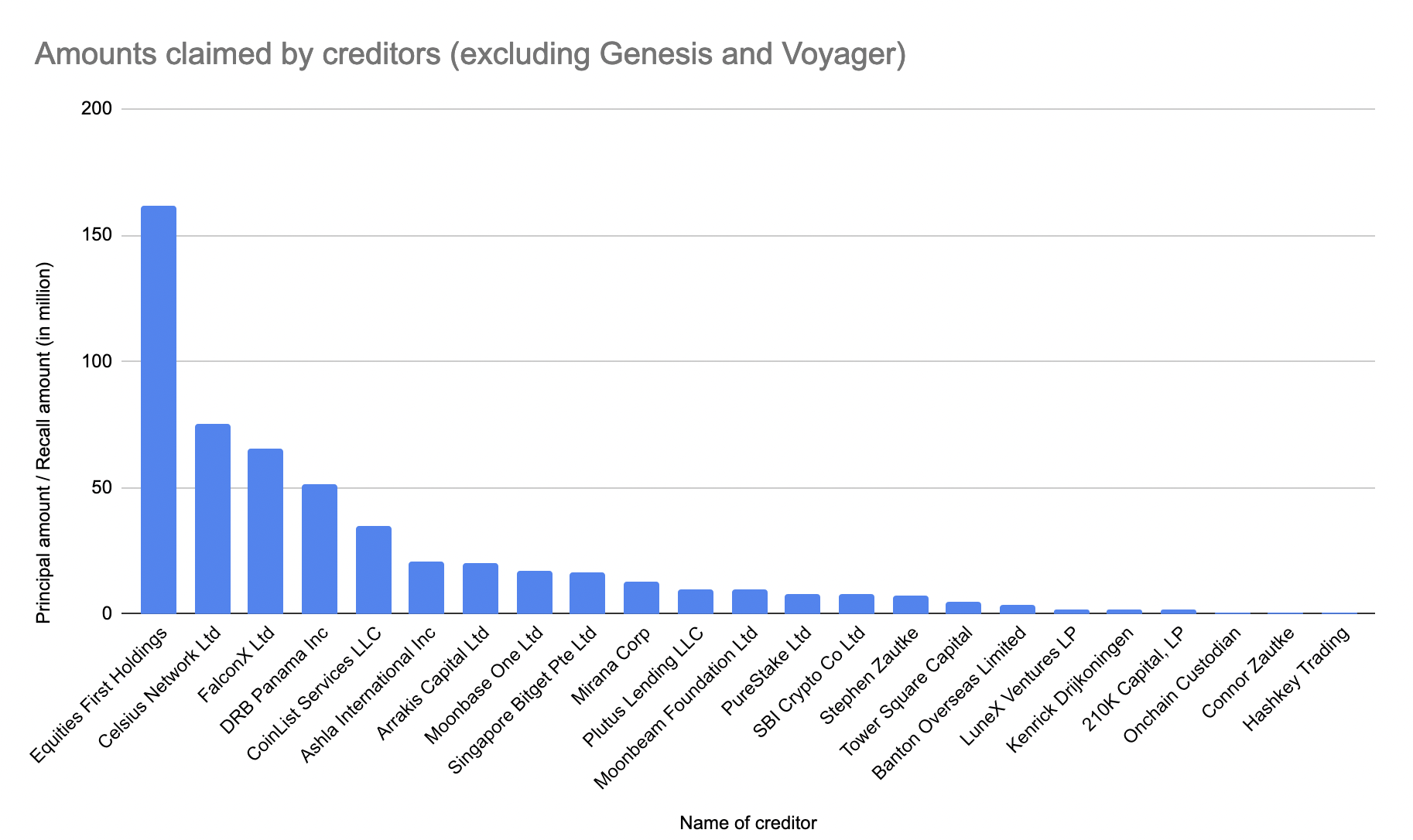

- A collection of affidavits show the extent to which nearly 30 crypto companies had lent billions of dollars to 3AC.

- Genesis is the biggest creditor of 3AC, with $2.3 billion lent to the now bankrupt crypto hedge fund.

- 3AC co-founder Zhu Su and the wife of another co-founder Kyle Davies are among creditors owed money from the fund.

Collapsed crypto hedge fund Three Arrows Capital (3AC) owed 27 crypto companies $3.5 billion, according to court documents published today by 3AC's liquidators.

The largest creditor on the list is Genesis Asia Pacific Pte Ltd., a unit of the brokerage subsidiary of Digital Currency Group (DCG), which had lent $2.3 billion to 3AC. Genesis CEO Michael Moro recently said that DCG had taken on some of Genesis’ liabilities.

3AC had grown into one of the crypto industry's biggest hedge funds before May's collapse of the Terra ecosystem left it facing significant losses.

The details of the 3AC loans were revealed in a 1,157-page legal document uploaded online on Monday by Teneo, the firm appointed last month to oversee 3AC's liquidation. The document — which The Block obtained before it became public — outlines claims against 3AC, which filed for Chapter 15 bankruptcy in New York a few days after a court in the British Virgin Islands appointed Teneo as liquidator.

A spokesperson for DCG today told The Block: “Both the DCG and Genesis balance sheets remain strong. With no remaining exposure to Three Arrows Capital, Genesis continues to be well-capitalized and its operations are business as usual.”

Voyager bankruptcy

Voyager Digital LLC, which recently filed for bankruptcy, follows Genesis with a loan of more than $685 million to 3AC in the form of bitcoin and ether — the amount calculated per current crypto prices.

Other high-profile creditors of 3AC include DRB Panama Inc., the parent company of crypto exchange Deribit, which lent 1,300 BTC and 15,000 ETH, worth around $51 million at current prices; Celsius Network (which lent around $75 million in USDC); CoinList Services ($35 million in USDC) and FalconX ($65 million).

Kushagra Shrivastava, vice president of executive operations and partnerships at FalconX, declined to comment on the amount lent to 3AC, saying that he couldn’t give details on relationships with specific customers. However, he told The Block that FalconX had “no material exposure or losses,” adding that the platform’s average collateralization is over 160%.

“Unlike other major lenders in the space, all credit on FalconX is overcollateralized with highly liquid collateral (not GBTC, for example) and extended within our closed loop ecosystem — enabling FalconX to maintain possession and control of these assets,” said Shrivastava, referring to the Grayscale Bitcoin Trust as GBTC.

He added: “Due to strong risk management, market risk neutral approach, and leveraging real -time on-chain analytics, FalconX came out of the liquidity crisis stronger than ever. Our balance sheet is the largest it has ever been. We continue to extend credit and have grown our credit business despite the market conditions.”

When reached for comment, a CoinList spokesperson told The Block: “We lent some assets from our own balance sheet to 3AC and they’ve defaulted on that loan. We’re in the legal process of trying to recoup those assets. Their default doesn’t affect any user funds, only assets from our own balance sheet. We raised a $100 million Series A in Oct 2021, have years of runway (even if we don’t recover any of the loaned assets), and will continue to help launch the best projects in crypto.”

These companies are creditors in the bankruptcy proceedings of 3AC and are seeking the return of their funds. Also included among creditors are 3AC co-founder Zhu Su, who is seeking $5 million, and 3AC co-founder Kyle Davies’ wife Chen Kelly, who is seeking $65 million.

Some of the companies had collateral in the form of bitcoin, other crypto tokens or shares in the Grayscale Bitcoin Trust.

Other creditors listed in the documents include SBI Crypto, Equities First Holdings, Tower Square Capital, Ashla International Inc, Plutus Lending LLC (aka Abra), Moonbeam Foundation, Moonbase One and PureStake.

The Block has reached out to 3AC, Deribit, SBI Crypto, CoinList, Celsius, 210K Capital, Hashkey Trading and Mirana Corp for comment, but did not hear back by press time. The other firms could not immediately be reached.

Update: The chart in this article has been updated to exclude Play Future Fund because the fund had no assets with 3AC, Play Future Fund's founder Kenrick Drijkoningen, who is also the founder of LuneX Ventures, told The Block.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.