Bitcoin back below $19,000 as crypto market falls following U.S. inflation data

Quick Take

- BTC was trading at $18,327 on Thursday, while ETH fell to $1,213.

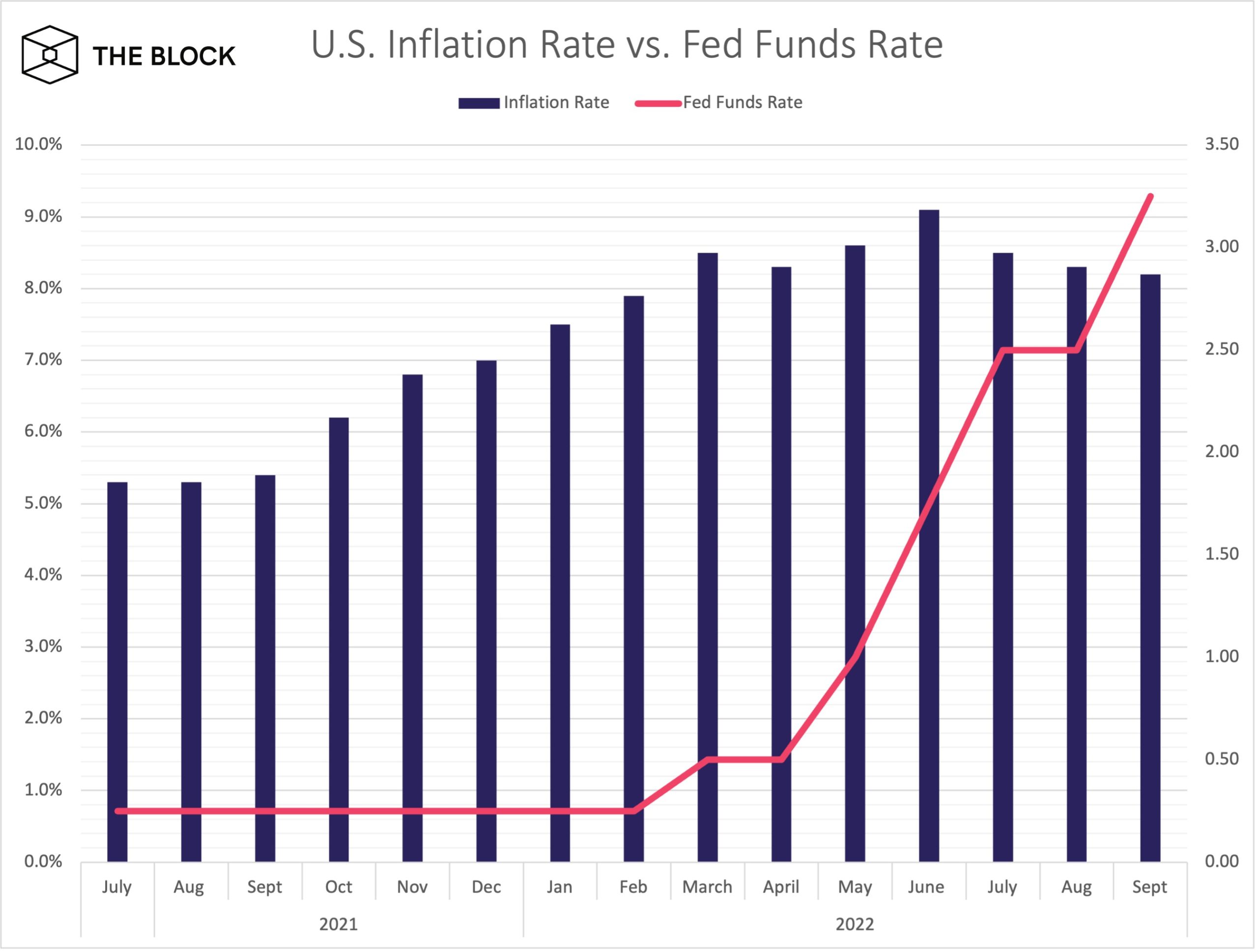

- U.S. inflation rose 8.2% year-on-year and 0.4% month-on-month.

- Core U.S. inflation hit 6.6%, — its highest point since 1982.

Crypto prices plunged following hot U.S. inflation numbers on Thursday.

BTC was trading at $18,327 on Coinbase — down roughly 3.8% over the past 24 hours, per data from the exchange.

ETH losses over the past 24 hours were even greater — dropping 6.2% to $1,213 — according to Coinbase data.

Thursday's downturn followed hotter-than-expected inflation figures from the United States. Headline inflation was up 0.4% month-on-month and 8.2% year-on-year. Meanwhile, core inflation rose to 6.6% — above estimates of 6.4% — and is at its highest point since 1982.

Altcoins, which suffered large losses over the past 24 hours, were again hit hard. ADA fell 7.4% while SOL lost over 8.5%, according to data from CoinGecko.

The losses in crypto markets track traditional markets, where S&P 500 futures turned red — down 1.88% shortly before the open. Nasdaq 100 futures lost 2.89%.

RELATED INDICES

Word on the street

When inflation is above expectations, BTC typically falls an average of 4% in the 30 minutes following the release, QCP Capital said before the data dropped. With BTC currently down approximately 2.2% since the data release, there could be more room to go, based on this analysis.

Markets must now contend with the deafening reality that further interest rate hikes from the Fed may follow today's news. A hotter-than-expected CPI reading would put a nail in the coffin to seal a 75bps interest rate hike from the Fed at the start of next month, Matt Well, global head of market research at Forex.com, explained to The Block earlier today.

source: bls.gov/cpi/

The CME’s FedWatch tool shows that traders are now pricing in a 90% or more probability of yet another 75 basis points interest-rate increase from the Fed in three weeks’ time, Weller noted, following the release. Some traders are even pricing in an outside chance of a full 100 basis point rate hike, he said.

Now, pressure is expected to remain heavy on price action with higher-than-expected inflation, Urs Bernegger, co-head of markets and investment solutions at SEBA bank, told The Block.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.