Bitcoin inches higher, GBTC discount narrows as share price perks up

Quick Take

- Bitcoin was trading at $17,400, up 1.2%.

- Altcoins moved higher as Ripple’s XRP jumped 5%.

- GBTC continues its positive start to the year; shares are approaching $10 as the fund’s discount to NAV narrows.

Crypto prices remain in the green while related stocks were mixed in pre-market trading. GBTC's continuing its positive start to the year.

Bitcoin was trading at $17,400 at 8:45 a.m. EST, up 1.2% over the past 24 hours, according to TradingView data.

Ether continues to trade around $1,300, adding 0.5%, while altcoins like Ripple's XRP jumped 5.1%. Polygon's MATIC added 2.2%, litecoin gained 1.7%.

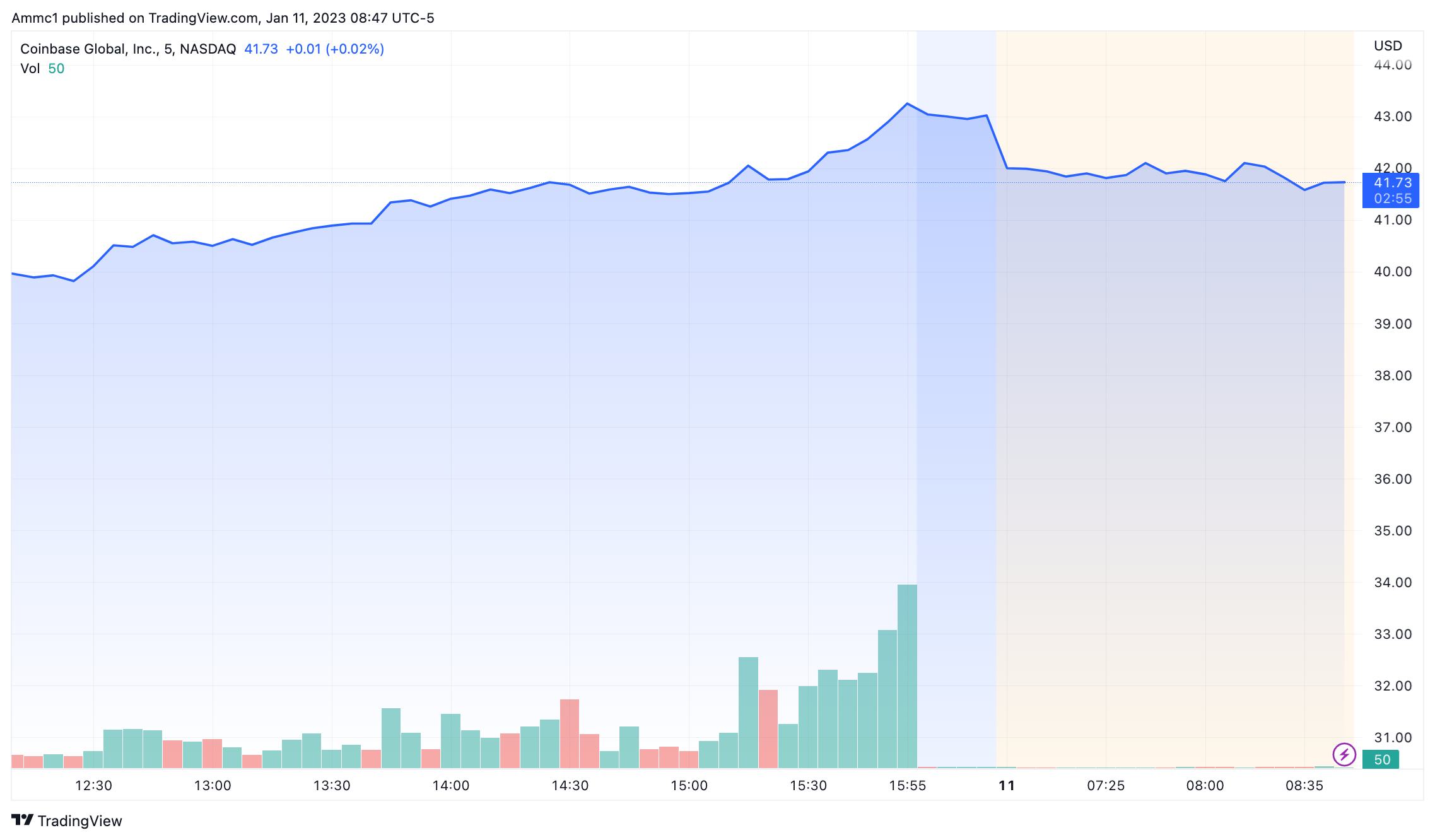

Crypto stocks

Coinbase dipped around 3.3% by 8:45 a.m. ET in pre-market trading, according to Nasdaq data. The exchange jumped 13% yesterday after announcing job cuts affecting about 20% of its workforce. Cathie Wood's Ark bought $1.46 million worth of COIN shares yesterday, according to a trade filing.

Silvergate dipped 1.6%, and Block was up 0.6%.

MicroStrategy was unchanged in the early session after closing up 8% yesterday. Derivatives firm Group One took a position in the software firm that included the option to buy 1.26 million MSTR shares.

RELATED INDICES

Grayscale's GBTC fund continued its positive start to the year. Shares in the fund are approaching $10 — up over 20% since last week — as the discount to net asset value (NAV) continues to narrow.

Shares in the GBTC fund now trade at a discount of 38% to the value of the bitcoin in the fund.

Macro matters

U.S. inflation data for December is slated for release tomorrow at 8:30 a.m. EST. November's data showed inflation was 7.1%, below estimates of 7.3%, which may result in lower interest rate hikes by the U.S. Federal Reserve.

Positive sentiment in crypto markets over the past few days has been supported by Friday's U.S. jobs data, said Ryan Shea, crypto economist at Trakx. The jobs report was important "as it raised hopes that in the absence of second-round effects — inflation begets more inflation due to higher wage costs — the Fed will be able to moderate or even bring to an end its tightening cycle and achieve a soft-landing: a positive outcome for risk assets."

"Consensus forecasts for December's inflation data show a further decline in the year-on-year rate of inflation both on headline and core, which would be entirely consistent with this outlook," he told The Block before adding that, "having already moved in a mildly bullish direction, the crypto market will be more sensitive to a higher inflation out-turn than a lower inflation out-turn."

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.