Suspected wash trading rife at major exchanges, per study

Quick Take

-

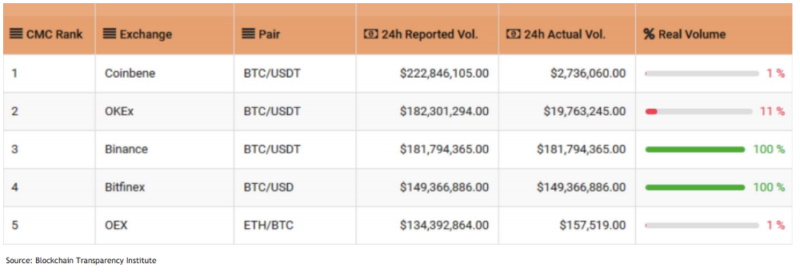

2 of the top 5 reported liquidity pairs have less than 1 percent of their actual reported volume

-

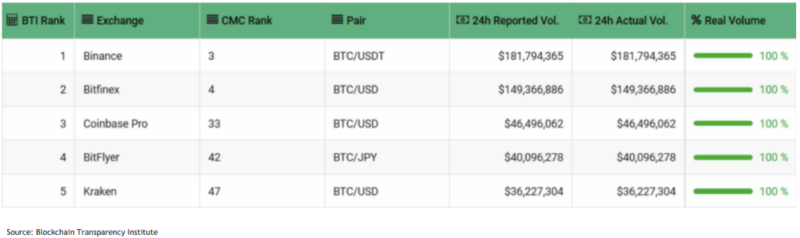

True liquidity is in bitcoin pairs on exchanges that have been operating since 2015 and have low API driven trades

CoVenture Crypto, a business line of CoVenture, released a study that analyzes the "true liquidity" of crypto exchanges by exploring where (exchanges) and what people trade (liquidity pairs). Key findings from the report include: 1) Reaching similar conclusions from the Blockchain Transparency Institute report that found 2 of the top 5 reported liquidity pairs have less than 1 percent of their reported volume and 2) true liquidity is in bitcoin pairs on exchanges that have been operating since 2015 (Coinbase Pro and Bitfinex) and have low API driven trades.

CoVenture Crypto believes, "For crypto markets to mature, smarter regulation needs to be implemented in order for more established traditional exchanges to enter the space. [As] more trading venues open and more financial derivatives are offered, we think that liquidity can 'flush out' a portion of the bad actors in the space as well as bring 'institutional legitimacy' into the markets."

Other highlights to note:

- Incentive to juice reported and actual volumes: Limited regulatory oversight has pushed crypto exchanges to explore high-margin businesses outside the reach of traditional financial regulated exchanges (ICO listings and prop trading). These activities rely on high volume which translates to higher listing fees and liquidity, ultimately enabling a feedback loop where traders gravitate to higher-volume exchanges.

- Total volumes are largely concentrated: The top 10 percent of exchanges make up 60 percent of total spot volume, while the top 25 makes up over 90 percent. Meanwhile regulated futures (CME and CBOE) represent less than 3 percent of total futures volumes.

- Not all volumes are equal: Unregulated exchanges are known to engage in forms of wash trading (buying and selling at the same price without changing ownership). Likely indicators of wash trading include a high percentage of API driven exchanges, large volume of transaction during off-hours, repeated transactions at same price, and no price volatility despite high liquidity. [related id="1"]

3 of the top 5 reported volume pairs have less than 1% their actual reported volume

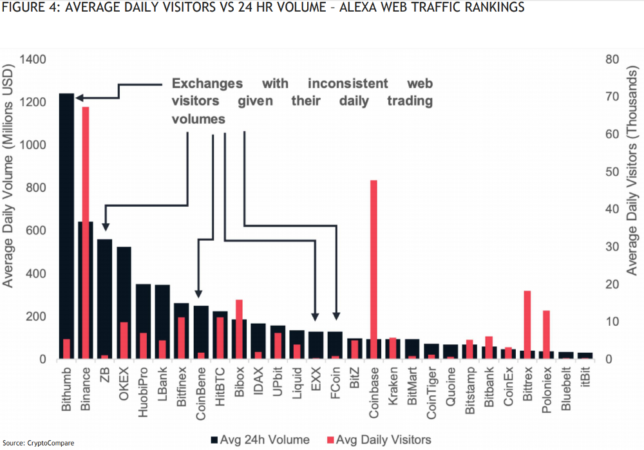

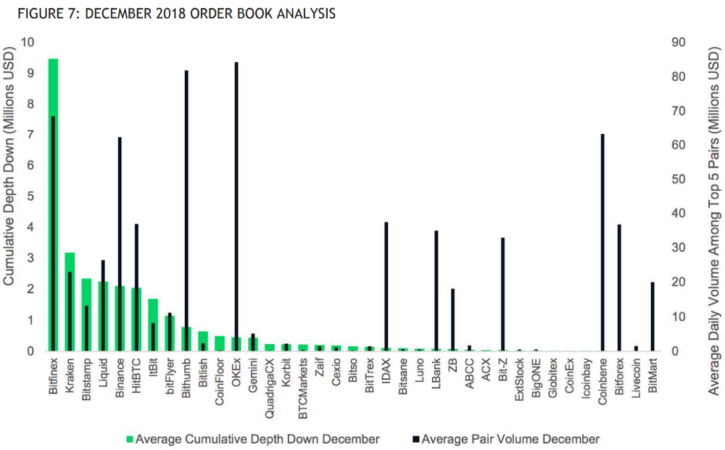

- Ways to test for suspicious reported volumes: CoVenture Crypto highlighted two ways to detect suspicious reported volumes. One measure is to compare average daily volume traded (CoVenture used CryptoCompare's API) to average daily visitors (using Alexa Web Traffic Rankings) to see if there are inconsistencies in the ratio, relative to peers. Another measure is to compare order book depth, specifically how much capital it would take to push crypto prices in a top 5 liquidity pairing down by 10 percent. An example of deceiving volumes not translating to true liquidity is exhibited with CoinBene metrics which reports similar 24-hour volumes as Bitfinex, but only take $13,600 worth of capital (vs. Bitfinex ~$9.47 million) to push the price of top liquidity pairs down by 10 percent!

RELATED INDICES

- Transaction mining exchange models indirectly promote wash trading: Contrast to a traditional maker and taker fee model, transaction mining takes fees but refunds all the fees back in the form of native exchange tokens. Examples include CoinBene and Bit-Z, both of which are now in the top 25 by reported volume, but incentivize wash trading bots to benefit from "net zero" trading fee environments.

- The smell test for legitimate reported volumes: Five key indicators of accurately reported volumes typically exhibit: relatively low API trades, bitcoin as its most liquid trading pair, ability to offer short capabilities, fiat to crypto on-ramps, and exchanges that started before 2014.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.