JPMorgan Chase, Wells Fargo among potentially exposed FTX parties

Quick Take

- FTX has named Kroll Restructuring Administration as a claims and noticing agent, a filing with federal bankruptcy court shows.

- The filing reveals companies and people affected by FTX’s collapse, including banks, celebrities and investors.

FTX has named Kroll Restructuring Administration as its agent as it navigates the federal bankruptcy process and cited dozens of companies and people affected by its collapse, a petition filed by the exchange shows.

Kroll is to act as a claims and noticing agent, often assigned to cases where creditors are in excess of 1,000 parties. As claims agent, Kroll will liaise between entities in the legal proceedings, managing documentation and preparing and serving related notices. FTX filed for Chapter 11 bankruptcy protection on Nov. 11 in the U.S. Bankruptcy Court for the District of Delaware.

Following the filing, FTX Group announced over Twitter that it established Kroll as its claims agent, and provided a link to where related documents filed to the U.S. Bankruptcy Court may be accessed.

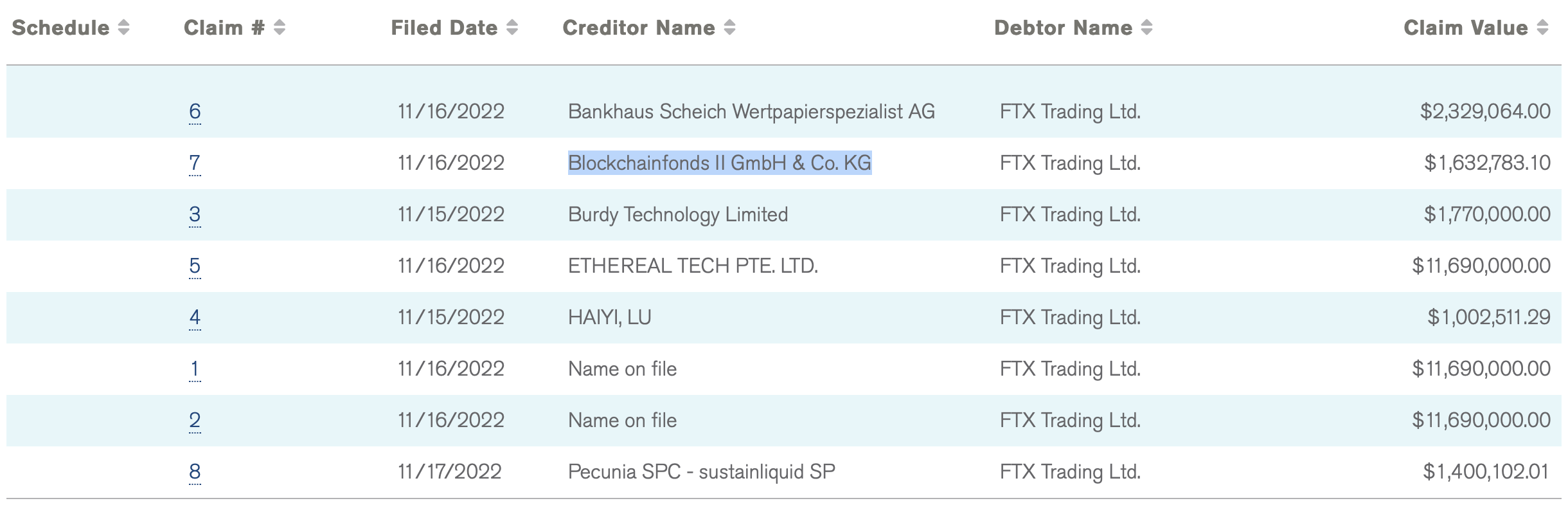

The documents provide a preliminary list of claims depicting outstanding millions owed to parties such as Bankhaus Scheich Wertpapierspezialist, Blockchainfonds, Ethereal Tech, as well as entities whose names remain “on file.”

Also included in Kroll documents is a list of 102 debtors, among them numerous entities associated with Alameda Research, as well as FTX, that have petitioned for Chapter 11 bankruptcy protection and moved for joint administration of the related case.

The filing would also appear to be a preliminary attempt to establish a list of creditors exposed to the collapse of FTX, although it remains unclear as to the specific extent of each party’s involvement with the fallen exchange.

The list “is based on the Debtors’ currently available information of creditors and does not include any information regarding the Debtors’ customers,” a footnote in the document reads, continuing, “Additionally, the Debtors’ professionals have not yet had the opportunity to independently verify certain of the roles, titles and affiliate relationships with respect to the parties listed herein and will supplement as necessary.”

The document names individuals and organizations ranging from equity holders of 5% or more, bankruptcy judges, professionals, banks lenders and administrative agents, contract counterparties and debtors. Also named are directors, officers, known affiliates, ordinary course professionals and landlords, as well as parties related to insurance, litigation, and finally governmental regulatory and tax agencies.

Currently it remains unclear as to the extent of the named organizations role in the collapse beyond the categorization.

A small selection of persons of interest includes:

5% equity holders

- Samuel Bankman-Fried

- Nishad Singh

- Zixiao Wang

Professionals

- Chainalysis

- Kroll Restructuring Administration

Banks and Financial Entities

- Bank of America

- Circle

- JPMorgan Chase Bank, N.A.

- Wells Fargo

- Silvergate Bank

Contract Counterparties

- Gisele Bundchen

- Kevin O’Leary

- Major League Baseball Clubs

- Mercedes-Benz Grand Prix Limited

- Multicoin Capital

- Stephen Curry

- Tom Brady

Debtors

- Numerous affiliates of Alameda Research

- Numerous affiliates of FTX

Taxing Authority/Governmental/Regulatory Agencies

- Securities and Exchange Commission

- Commodity Futures Trading Commission

- Department of Justice - National Crypto Currency Enforcement Team

Vendors

- Facebook/Meta

- Apple Inc.

- CoinDesk

Disclaimer: The Block Crypto is listed as a vendor of FTX

Update: This story has been updated to include financial entities other than banks in the subheading above.

Disclaimer: The former CEO and majority shareholder of The Block has disclosed a series of loans from former FTX and Alameda founder Sam Bankman-Fried.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.