'We're not sharks': Haun Ventures' Sam Rosenblum on haggling hard in crypto investing

Quick Take

- A year on from Haun Ventures raising $1.5 billion, the firm remains as cautious as ever when it comes to deploying capital.

- Haun’s Sam Rosenblum shares why the firm’s hunt for venture-like returns isn’t an attempt to “lowball” startups or “be sharks.”

Ask a crypto founder for reasons for cheer amid a punishing bear market and the $1.5 billion raised by Haun Ventures last year will probably get a mention.

What those founders might not realize is that Haun Ventures, the venture capital firm founded by former Andreessen Horowitz general partner Katie Haun, isn’t exactly splashing the cash.

“When we started the firm, even though it was only a little over a year ago, it was a very different time in crypto,” said Sam Rosenblum, partner and investment team lead at Haun Ventures. “You have these multibillion-dollar crypto venture funds that were deploying billions of dollars over the course of a year like really [fast] pace.”

“One of the things Katie and I had both though of independently, but then of course when we came together, was that we wanted to slow the pace down quite a bit relative to what was in vogue at the time.”

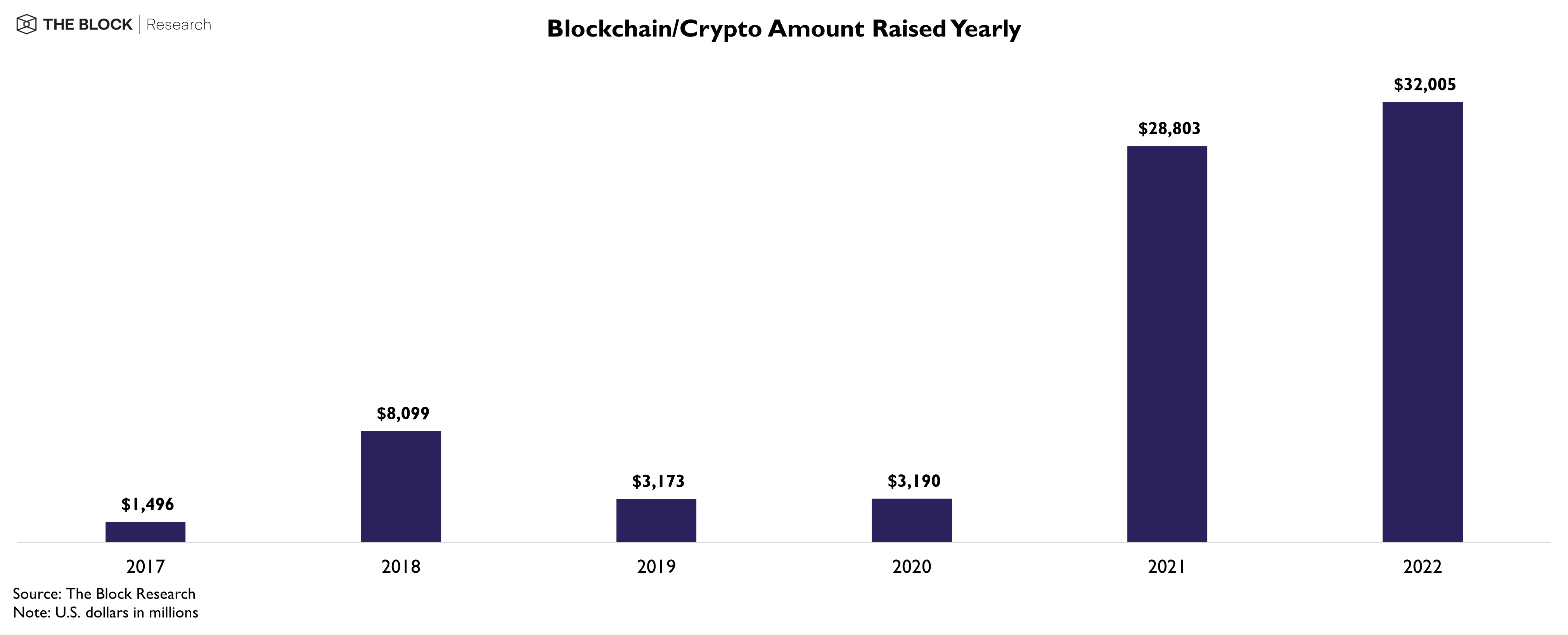

There was certainly room to slow down. In 2022 and 2021, venture capitalists poured $61 billion into crypto startups. That's 79% of the total of $77 billion invested in the sector since 2017, according to data from The Block Research.

Haun Ventures remains coy about exactly much of the $1.5 billion raised has so far been deployed. It’s publicly disclosed investments in 11 web3 startups relative to the 66 made by venture giant Andreessen Horowitz (A16Z) since the start of 2022 or the 41 that Seqouia backed during the period, according to data from The Block Research.

“We are still, certainly, majority dry powder, and we continue to be thinking in terms of years, not months,” Rosenblum said. “I think the key thing in terms of the two funds is we thus far are deploying them, not in lockstep, but very similar pacing across the two.”

Amounts raised by crypto startups by year from The Block Research

'We're not trying to be sharks'

Raising such a large fund was very much a strategic decision, however.

“We wanted to be in a position where we could do both of those things, we wanted to be able to lead and even lead and double down in things that we wanted to do that for,” Rosenblum said. “We also wanted to be in a position where we could be collaborative with other funds and we didn't need to have sharp elbows and just taking all the allocation for ourselves every time."

The trick, Rosenblum says, is for funds not to get so large that they feel pressure to invest as many dollars as possible to maintain a certain deployment pace, which can come at the cost of not playing nice with others in funding rounds.

Yet while Haun wants to be collaborative with other investors, it takes a tough stance when it comes to valuations. As many venture capitalists heralded an era of cheaper startups last year, only recently has Rosenblum's team seen valuations really come down — especially for well-known founders that have already secured some form of product-market fit.

“Midway through last year, I think the music had stopped, but some people were able to keep on dancing for longer than others,” Rosenblum said. “We're not trying to lowball or be sharks, we're trying to apply what we think is the appropriate fair market value — even in a market where other investors may be willing to pay much higher.”

Haun's Coinbase and A16Z mafia

Rosenblum picked up his investing chops at Coinbase, where he was an early employee. He helped the exchange make its first balance sheet investment and then continued to lead the corporate development function before moving to another storied crypto institution, Polychain Capital.

Investing titan Katie Haun joined Coinbase’s board in 2017, which is where she met Andreesen Horowitz's co-founder Marc Andreessen. Haun later joined A16z, where she co-led the firm’s first three crypto funds. Many members of Haun’s team either hail from Coinbase or A16Z.

“It wasn’t like there was 20 crypto startups to decide between,” Rosenblum said of his earlier career moves. “Coinbase was clearly the best group of people in the Bay Area working on a crypto thing at the time and that was the top thing to strive for.”

Rosenblum and Haun both set out to raise their own crypto venture funds in 2021. The Coinbase connection is ultimately what pulled them to launch Haun Ventures together over a year ago.

“Katie and I ended up spending a few days together out here in Menlo Park and over the course of several laps around the Stanford Dish, for me, I made the decision that this, again was the right group of people for this moment in time to be to be working with,” Rosenblum said.

Not a 'growth fund'

They launched with two funds: an early-stage fund that invests in “themes of the future” such as scalability, interoperability and privacy and an acceleration fund for when the team wants to double down on or invest in crypto projects that are “growing and winning.”

So far, Haun Ventures has backed startups such as zero-knowledge firm Sovereign Labs, NFT marketplace Zora and Layer 1 blockchain Aptos.

Rosenblum doesn’t shy away from the fact that ultimately Haun Ventures’ goal is to achieve venture-like returns. And when it comes to returns, he won’t hear of the acceleration fund being branded a "growth" fund.

“We specifically don't call it a growth fund because generally when people hear ‘growth fund,’ they think of things that are going for like a 3x type of outcome and that's not really what we're interested in,” Rosenblum said.

Securing returns might be even more difficult as the fund enters its second year, with the Federal Reserve forecast to raise interest rates further in an effort to cool inflation. Several of the industry’s leading banking partners — Silvergate, Silicon Valley Bank and Signature Bank —have felt this pain and closed their doors after being unable to meet a surge of withdrawal requests due to duration mismatches within their bond portfolios.

The collapse of those banking partners didn’t have a broad impact on Haun’s portfolio, Rosenblum said. However, the team are now heads down helping founders navigate the uncertain regulatory environment and helping to secure connections with banking partners.

“To the extent you find yourself in a position to deploy a lot of your fund in a market that’s actually underheated or overly pessimistic relative to progress being made, that’s a really nice time to be able to invest,” Rosenblum said. “Despite the current situation in the U.S., as a team we see genuine bright spots and are optimistic.”

This story has been updated with data from the Haun team on the number of publicly disclosed deals its participated in and to clarify that Katie Haun was on Coinbase's board prior to joining A16z.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.