Coinbase is set to enter the lending space this fall, will enable cash loans for bitcoin collateral

Quick Take

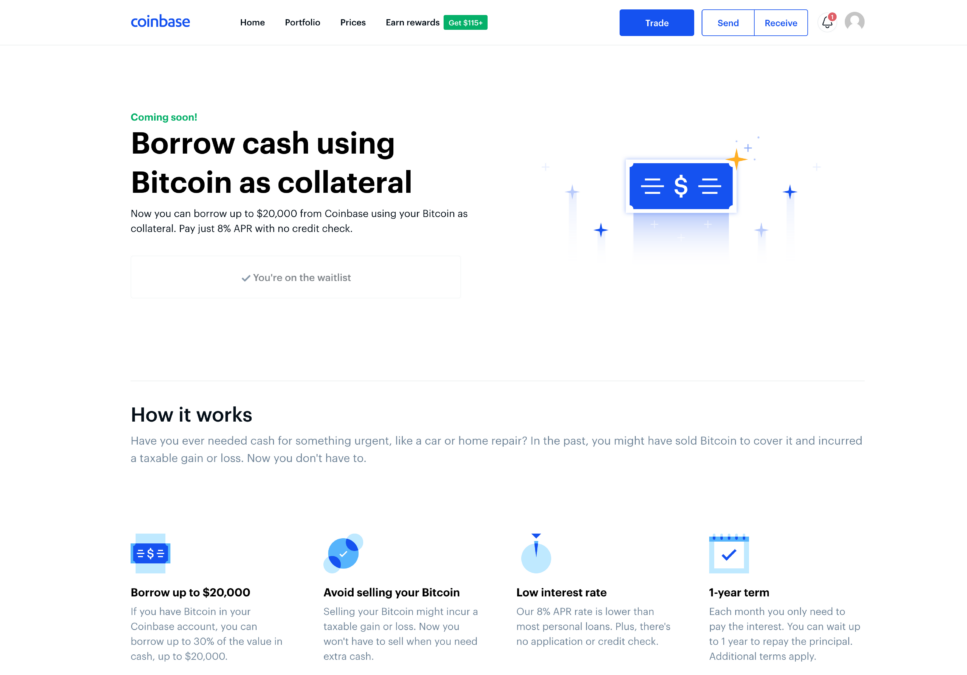

- Coinbase is set to offer cash loans with bitcoin as collateral in select U.S. states.

- A Coinbase spokesperson told The Block that the new “Borrow” feature is set to go live in the fall.

Crypto exchange behemoth Coinbase has ventured into the lending space, a move that would put it directly in competition with industry players like BlockFi.

In a blog post shared with The Block on Wednesday, Coinbase said customers in select U.S. states would soon be able to borrow cash by using bitcoin (BTC) as collateral. At launch, Coinbase plans to support 17 states: Alaska, Arkansas, Connecticut, Florida, Georgia, Illinois, Massachusetts, New Hampshire, New Jersey, North Carolina, Oregon, Texas, Virginia, Nebraska, Utah, Wisconsin and Wyoming.

The new "Borrow" feature is currently on a waitlist and is set to go live in the fall, a Coinbase spokesperson told The Block. While starting with bitcoin, Coinbase has plans to explore more crypto assets in the future, as well as support more states. "We are actively pursuing licenses in many more states in the U.S."

Loan terms

Coinbase would offer cash loans of up to 30% of customers' bitcoin holdings or a maximum of up to $20,000. As for interest rates, the exchange would charge a fixed annual rate of 8%, for the maximum repayment period of one year.

"All customers will maintain the 8% rate that they are offered when they take the loan, for the duration of the loan term," the spokesperson told The Block. However, Coinbase may review the rate over time, based on factors including market conditions, the spokesperson added.

In comparison, interest rates of BlockFi vary based on customers' risk profiles and other factors. They start at as low as 4.5% p.a. A quick check on BlockFi's website shows that the firm charges a 9.70% interest rate for borrowing $20,000 worth of cash against bitcoin as collateral, at 35% loan-to-value (LTV) ratio (BlockFi doesn't have 30% LTV, but offers up to 50% LTVs). BlockFi also supports ether (ETH) and litecoin (LTC) as collateral.

Cash loans against crypto are usually taken by customers to meet short-term needs such as home renovations or car repairs, without having to sell their crypto prematurely or take out high-interest personal loans. Coinbase said its customers wouldn't need to fill out a lengthy application or go through a credit check and would be able to get cash "within 2-3 days."

BlockFi stands as a key competitor for Coinbase, since both firms are reportedly looking to go public in the near future. However, Ripple is also working on a loan product, as The Block reported recently. Some other players in the lending space include Celsius, Nexo, and SALT Lending, among others.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.