Ether options open interest on CME on track to hit fresh all-time high

Quick Take

- Ether options open interest on CME for February has already exceeded figures seen during the whole month of January.

- Ether’s price increased by almost 8% in the past 24 hours, according to The Block’s Price Page.

Ether options open interest on the Chicago Mercantile Exchange (CME) for February has already exceeded figures seen during the whole month of January, and is on track to hit a fresh all-time high, according to The Block's Data Dashboard.

CME ether options open interest for February has reached $468 million, with still almost two weeks to go before the end-of-month expiry on Friday, Feb. 23. Current ether open interest exceeds that for the whole month of January, which reached $385 million. Open interest for February is now just shy of December's all-time high of $510 million.

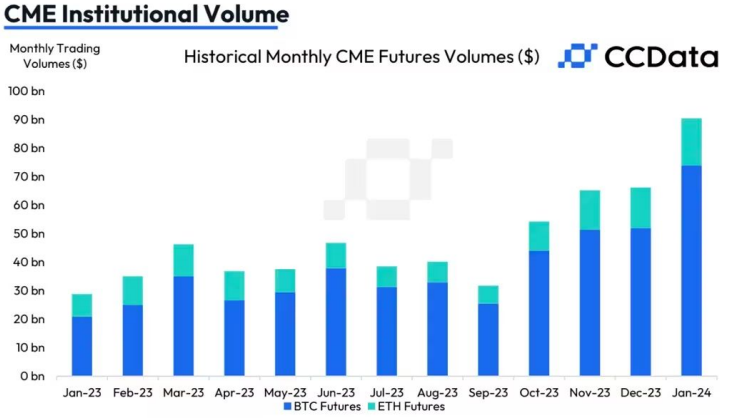

Crypto trading volume on CME

According to Bitfinex analysts, trading volume for both bitcoin and ether futures on CME experienced a significant increase in activity in January, which coincided with the approval of multiple spot bitcoin ETFs by the US Securities and Exchange Commission (SEC). "Trading volumes on the CME surged by 35% in January, reaching a high of $94.9 billion, the most substantial volume since October 2021. This indicates heightened institutional interest in cryptocurrency exposure," Bitfinex analysts said in an email sent to The Block.

RELATED INDICES

Institutional trading volume on the Chicago Mercantile Exchange has reached an all-time high. Image: CCData

The Bitfinex analysts noted that ether futures saw significant increases in January. "The trading volume for ether futures on the CME also increased by 15.6% in January, driven by speculation around the potential approval of an ether ETF, with several applications pending SEC review," Monday's Bitfinex Alpha report said.

The price of ether increased 7.83% to $2,681 at 7:00 a.m. ET, according to The Block's Price Page.

The price of ether has increased almost 8% in the past 24 hours. Image: The Block.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.