Ethereum is burning ETH at a rate of $5.5 billion per year as Shapella upgrade approaches

Quick Take

- Ethereum is burning ether at a rate of $5.5 billion annually, according to ultrasound.money.

- Had The Merge never occurred, the ether supply would have increased by $4.5 billion over the last 208 days.

Going into Ethereum's high-profile "Shapella" upgrade, the leading smart-contract protocol is burning ether at a rate of $5.5 billion per year, according to data-tracking website ultrasound.money.

Ethereum began burning ether 613 days ago when it implemented Ethereum Improvement Proposal 1559 — which burns a portion of fees generated through transactions — but EIP-1559 itself hasn't decreased the blockchain's total supply. Since EIP-1559 went live, the total supply of ether has increased by 3.23 million coins ($6.2 billion).

It wasn't until Ethereum implemented its high-profile switch from the energy-intensive proof-of-work to the more environmentally friendly proof-of-stake consensus mechanism — commonly known as "The Merge" — that the ether supply began to shrink in earnest.

When The Merge occurred, it reduced the number of rewards given to those running the network. In combination with EIP-1559's burning mechanism, this has had the effect of reducing the supply of ether.

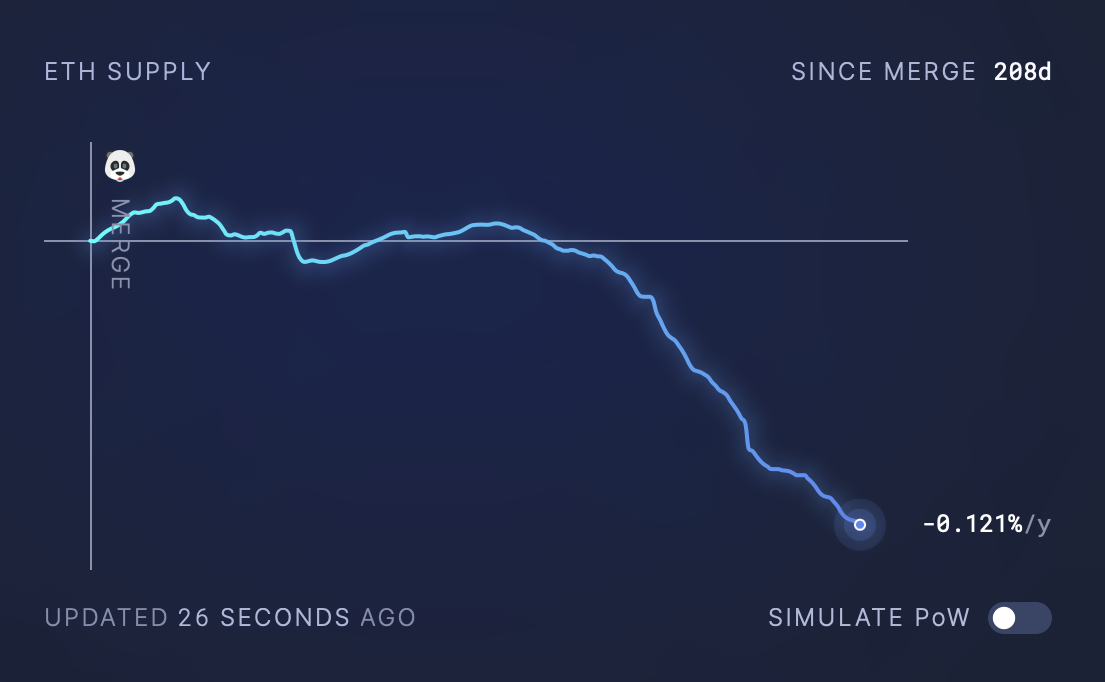

Since The Merge took place 208 days ago, the total supply of ether has dropped by 82,924 coins (more than $159 million). Had The Merge never occurred, the ether supply would have increased by 2.33 million ($4.5 billion) coins over the last 208 days, or 5.66 million ETH ($10.9 billion) since EIP-1559.

The Merge reduced the supply of ether by 0.121% per year. Source: ultrasound.money

Ethereum rewards are locked (but not for much longer)

Alongside The Merge came the temporary suspension of unstaking ether, which will be resolved soon by implementing Ethereum's Shanghai and Capella upgrades — known together as "Shapella" — on April 12.

The upgrades will enable the withdrawal of staked ether in a phased manner, allowing staking pools to control the release of rewards.

For instance, Coinbase announced that it would start processing unstaking requests 24 hours after the completion of the upgrade. However, the exchange also mentioned that, due to high demand, the protocol might take weeks (or even months) to process all unstaking requests.

Lido Finance, a major player in ether staking, anticipates that stETH withdrawals won't be initiated on the mainnet until around mid-May, following the completion of code audits and a two-week safety buffer.

The potential delays in withdrawal processing are mainly attributed to technical on-chain constraints. Only 16 partial withdrawal requests, consisting solely of staking rewards, can be processed approximately every 12 seconds. As a result, the queue for withdrawals could become quite long once Shapella is live.

Additionally, full withdrawals, wherein a validator entirely exits the Ethereum blockchain, might also take considerable time.

Updated with more information about the source of the data used.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.