Bitcoin futures open interest on CME hits all-time high

Quick Take

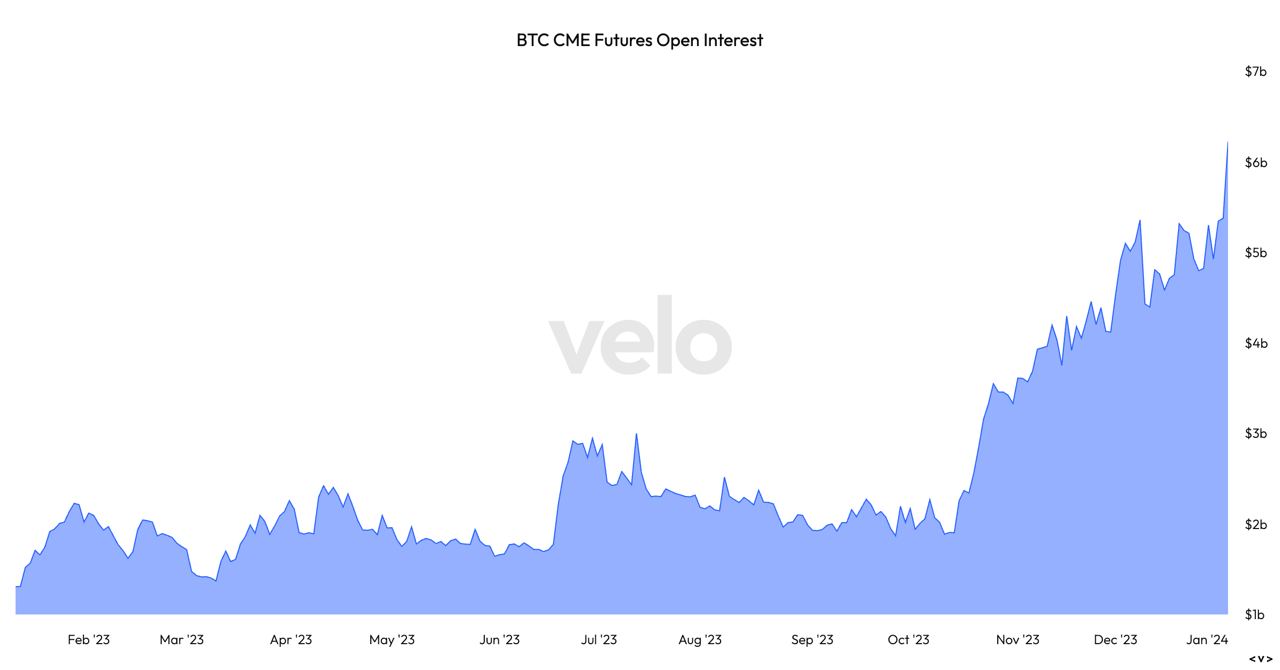

- Bitcoin futures open interest on the Chicago Mercantile Exchange has hit a fresh all-time high.

- The open interest in bitcoin long futures, held by asset managers on CME, also reached an all-time high, suggesting sophisticated traders anticipate price appreciation.

The open interest of bitcoin futures on the Chicago Mercantile Exchange has reached an all-time high, according to multiple data sources.

Bitcoin  BTC

+3.70%

futures open interest reached $5.4 billion on the CME, according to The Block's Data Dashboard. The recent rise is notably higher than the previous all-time high of $4.5 billion, which was recorded in November 2021 when bitcoin reached its peak of over $68,000.

BTC

+3.70%

futures open interest reached $5.4 billion on the CME, according to The Block's Data Dashboard. The recent rise is notably higher than the previous all-time high of $4.5 billion, which was recorded in November 2021 when bitcoin reached its peak of over $68,000.

Velo Data recorded bitcoin CME futures open interest spiking above the $6 billion mark in the past 24 hours. The increase in outstanding futures contracts on CME indicates heightened participation by institutional traders, who may be anticipating potential approvals of spot bitcoin ETFs later this week.

Bitcoin futures open interest on CME has reached an all-time high. Image: Velo Data

According to Coinglass data, in November 2023, the CME surpassed the Binance Futures platform in terms of open interest volume for bitcoin, indicating growing demand from institutional investors. Coinglass recorded a 12% increase in bitcoin futures open interest on CME in the past 24 hours, now valued at $6.2 billion.

Increase in bitcoin futures held by asset managers

The open interest in bitcoin long futures held by asset managers on the CME also reached an all-time high, increasing from $2.45 billion at the end of December to a current value of $2.52 billion, according to The Block's Data Dashboard.

The current value of the contracts held by asset managers has been climbing steadily since October 2023.

RELATED INDICES

The uptick in open long futures contracts suggests asset managers are anticipating bitcoin price appreciation by the time the current contracts expire on the last Friday of January.

The open interest from hedge funds going short on bitcoin futures on the CME is also at a high point. Currently, there's $2.7 billion of open interest from hedge funds going short, which remains below the all-time high of $2.9 billion in November 2021.

Overall, asset managers have a net long position that's $2.5 billion in size, while hedge funds have a net short position, worth $2.1 billion, according to The Block's Data Dashboard.

Data from The Block's Data Dashboard also shows an uptick in large open interest holders of CME bitcoin futures, for both long and short positions. The uptick in open interest for positions involving at least 25 bitcoin shows increased activity in the derivatives market by participants with large holdings. This would suggest market activity is leaning towards trades by more sophisticated, experienced investors.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.