An institutional crypto broker multi-factor index inches further into bullish territory amidst recent volatility

SFOX, a crypto institutional prime-dealer which recently raised ~$20 million led by Social Capital and Tribe Capital, released its March volatility report refreshing volatility, correlations, and other metrics to date in 2019. The full report can be viewed here, with some highlights including:

RELATED INDICES

- The SFOX Multi-Factor Market Index has swung from moderately bearish entering 2019 to moderately bullish through March. The index is a proprietary model that looks at quantifiable market factors such as volatility, market sentiment/news coverage, adoption, etc.

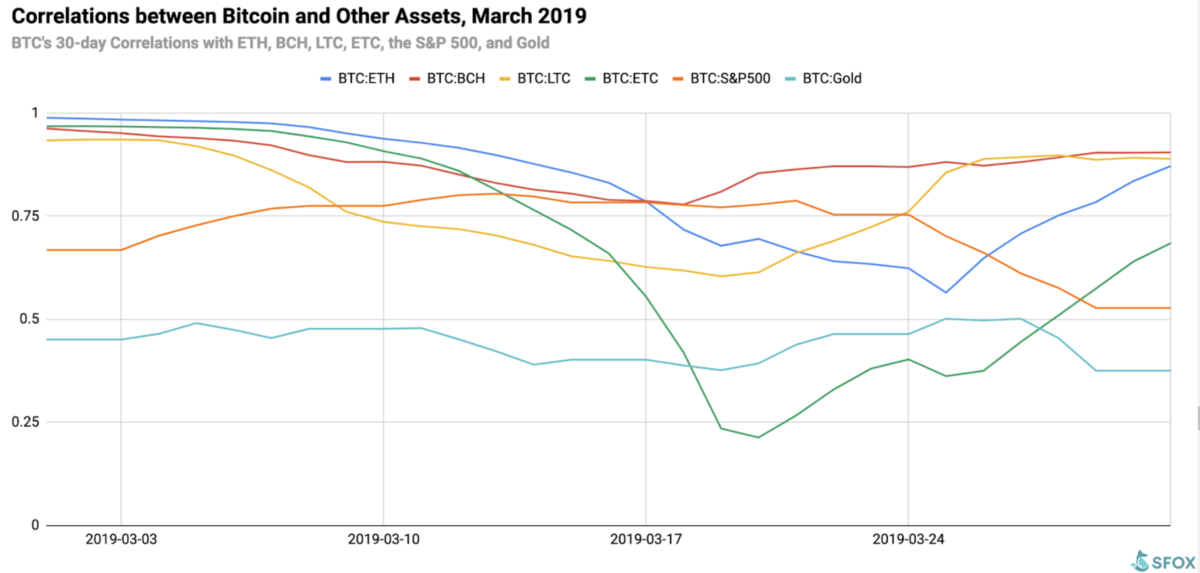

- BTC’s 30-day price correlations to ETH, BCH, LTC, and ETC all closed the month close to 1 (highly correlated). The cryptoasset least correlated to BTC was ETC, with a correlation of 0.685; the least correlated cryptoasset pair was LTC and ETC, with a correlation of 0.453.

- Of note, correlations between BTC and ETC steadily decreased from the beginning of March through March 20, at which point the two were at a fairly low positive correlation of 0.21.