Cathie Wood's Ark continues Coinbase buying spree, adds stock for second day in a row

Quick Take

- For the second day in a row, Cathie Wood’s Ark Invest has purchased stock in Coinbase.

- Yesterday’s purchase of $7.5 million follows the previous day’s addition of $8.4 million.

Ark Invest purchased stock in crypto exchange Coinbase for the second consecutive day, buying roughly $7.5 million of shares.

Yesterday, Ark's Innovation exchange-traded fund added 112,949 shares, worth nearly $5.8 million at current prices. At the same time, the American investment management firm's Next Generation Internet ETF added 20,313 shares, worth more than $1 million, while its Fintech Innovation ETF added 13,875 shares, worth over $712,000. Information regarding the purchases comes by way of a trade notification shared today.

Only the day before, Ark Invest purchased roughly $8.4 million in Coinbase stock. The firm had then added 129,604 Coinbase shares to its Innovation ETF. It had also added 23,456 shares to its Next Generation Internet ETF and 15,809 shares to its Fintech Innovation ETF.

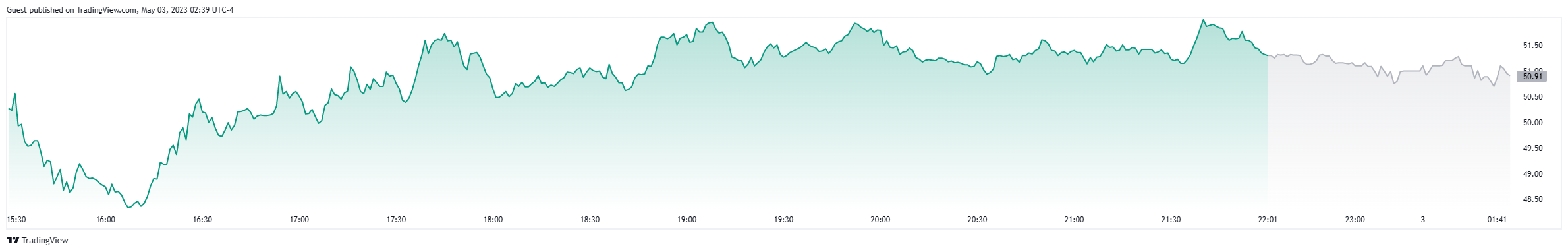

Coinbase's share price is currently above $51 after seeing a year-to-date increase of over 50%.

Coinbase's stock price is up more than 2% over its most recent trading. Source: TradingView

Regular buyers (and sometimes sellers) of Coinbase stock, the Cathie Wood-led investment firm also bought nearly $8.6 million in Coinbase stock late last month. That purchase occurred on the same day, April 25, that the publicly traded centralized crypto exchange announced it would be suing the U.S. Securities and Exchange Commission. At the time, Ark's Innovation ETF purchased 122,083 shares in the company, its Next Generation Internet ETF added 20,327 shares and its Fintech Innovation ETF bought 14,633 shares.

On the same day, The Block also reported that Ark Invest teamed up with 21Shares in another attempt to get a spot bitcoin ETF approved — a result both companies failed to receive from the SEC approval on their previous two applications. The pair's first attempt came back in 2021, while a second filing was made last May. The SEC rejected the most recent application in January.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.