Bitcoin could rise in 2024 even if spot ETFs are not approved, Matrixport says

Quick Take

- Analyst Markus Thielen said he expects higher crypto prices in 2024 — with or without spot bitcoin ETF approvals — as increased liquidity, the Bitcoin halving event and the potential for Donald Trump to be elected again provide further catalysts.

Matrixport analyst Markus Thielen is expecting higher crypto market prices in 2024 — even if a spot bitcoin ETF is not approved by the Securities and Exchange Commission — with increased liquidity, the Bitcoin  BTC

+0.65%

halving event and the potential for Donald Trump to be elected again providing further catalysts.

BTC

+0.65%

halving event and the potential for Donald Trump to be elected again providing further catalysts.

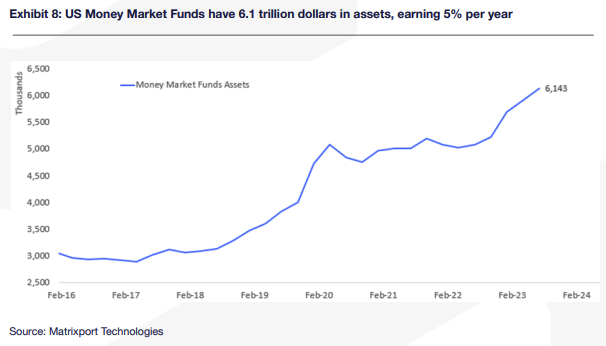

Since the Covid pandemic, the amount of money in U.S. money market funds has risen from $3 trillion to $6.1 trillion, Thielen wrote in the digital assets financial services firm's latest report.

This increase means there's now about $370 billion paid in interest each year, which works out to around $1 billion every day — money that can "easily" find its way into more risky investments like stocks and crypto, Thielen said. Additionally, the $6.1 trillion in principal might also be used to push up the prices of assets, he argued.

U.S. money market funds. Image: Matrixport.

The Bitcoin halving event and potential election of Donald Trump

Next year is a Bitcoin halving year, when the block reward gets cut in half from 6.25 bitcoin to 3.125 BTC. The halving is expected to occur in April, with Thielen noting bitcoin prices have risen 192% on average in such years.

RELATED INDICES

As 2024 is also a U.S. presidential election year, Thielen added there was a "high likelihood" that former President Donald Trump will be elected again, with his policies potentially boosting the U.S. economy, alongside the stock market and crypto prices, the analyst said.

Thielen noted that despite the potential for a Republican President to be back in control of the White House, Democrat SEC Chair Gary Gensler could remain in office until his term expires in June 2026. Thielen expects a spot bitcoin ETF to have been approved by then anyway, but added that Trump — who launched his own NFT collection last year and new "Mugshot Edition" NFT trading cards this week — "will likely support another initiative that cements digital assets as a cornerstone of the economy."

However, in terms of the remaining weeks of 2023, Thielen expects bitcoin prices to remain within the $40,000 to $45,000 range before another rally attempt in January as traders eye potential spot bitcoin ETF approval dates. Bitcoin is currently trading at $42,652, according to The Block’s price data — up over 150% year-to-date.

BTC/USD price chart. Image: The Block/TradingView.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.