Cathie Wood’s Ark Invest sold $59 million worth of Coinbase shares, $15 million of GBTC last week

Quick Take

- Ark Invest offloaded another 18,962 Coinbase shares on Friday — worth around $2.8 million — following the $56 million in COIN it sold earlier last week.

- Ark also disposed of more Grayscale Bitcoin Trust shares on Friday — offloading 12,000 GBTC ($409,000) in addition to the $14.5 million GBTC it sold on Monday and Wednesday.

Ark Invest’s Coinbase selling spree continued last week, offloading $59 million worth of shares after disposing of another 18,962 COIN ($2.8 million) on Friday, according to the company’s latest trade filing. Cathie Wood’s investment management firm sold 12,142 Coinbase shares ($1.8 million) from its Innovation ETF, 2,278 ($337,000) from its Next Generation Internet ETF and 4,542 ($672,000) from its Fintech Innovation ETF.

Adding to the $42.6 million worth of COIN it sold on Wednesday, $11.5 million on Tuesday and $1.9 million on Monday, Ark unloaded a total of $58.8 million in Coinbase shares last week as it continues to rebalance its fund weightings amid a surge in COIN stock over the past month. Ark also disposed of $100 million worth of Coinbase shares in the prior week.

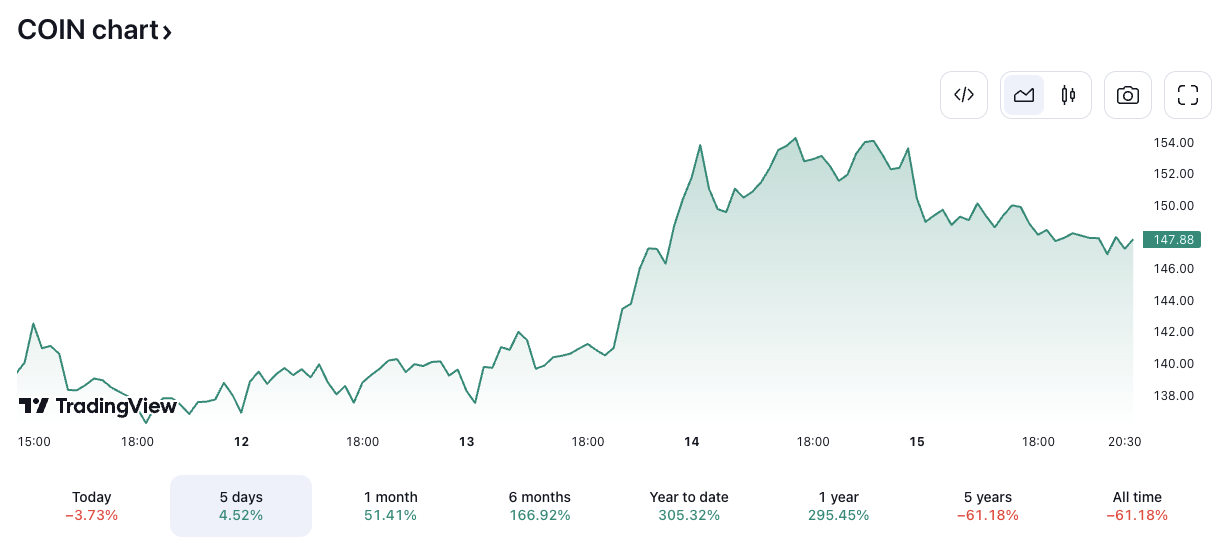

Coinbase stock traded for $147.90 at market close on Friday — up around 4.5% for the week, 50% for the past month and more than 305% year-to-date to reach its highest price since April 2022, according to TradingView. However, the stock remains roughly 60% down from an all-time high of approximately $343 set during November 2021’s peak crypto bull market.

COIN/USD price chart. Image: TradingView.

Coinbase is currently valued at $27.5 billion, according to The Block’s data dashboard.

Ark offloads $15 million worth of GBTC as discount-to-NAV narrows and bitcoin falls

Ark also sold 12,000 Grayscale Bitcoin Trust shares ($409,000) on Friday amid gains for the stock last week as GBTC's discount-to-NAV narrowed to its lowest level since July 2021.

In addition to the $1.6 million in GBTC it sold on Wednesday and $12.9 million on Monday, Ark offloaded a total of $14.9 million worth of GBTC shares last week.

RELATED INDICES

GBTC traded for $34.10 at market close on Friday, having gained nearly 2% for the week and 315% year-to-date, according to TradingView. GBTC shares remain around 40% down from a high of $56.70 set in February 2021.

GBTC/USD price chart. Image: TradingView.

GBTC daily trading volume hit $143 million on Friday, again significantly down from a peak of $1.5 billion in 2021, according to The Block’s data dashboard.

Ark’s GBTC sales follow a significant narrowing for GBTC’s discount to net asset value in recent months from 44% in June to 7.4% on Dec. 14 — the smallest in around two and a half years, according to YCharts. Discount to NAV means how much lower the market price of each share is than the value of the bitcoin it represents. GBTC’s discount to NAV is currently 9.87%.

GBTC discount to NAV. Image: YCharts.

Bitcoin went the other direction last week, falling around 5% to end an eight-week streak of consecutive weekly gains. Bitcoin currently trades at 41,157, according to The Block’s price data.

BTC/USD. Image: The Block/TradingView.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.