Swell liquid staking protocol sees over $125 million of inflows in December

Quick Take

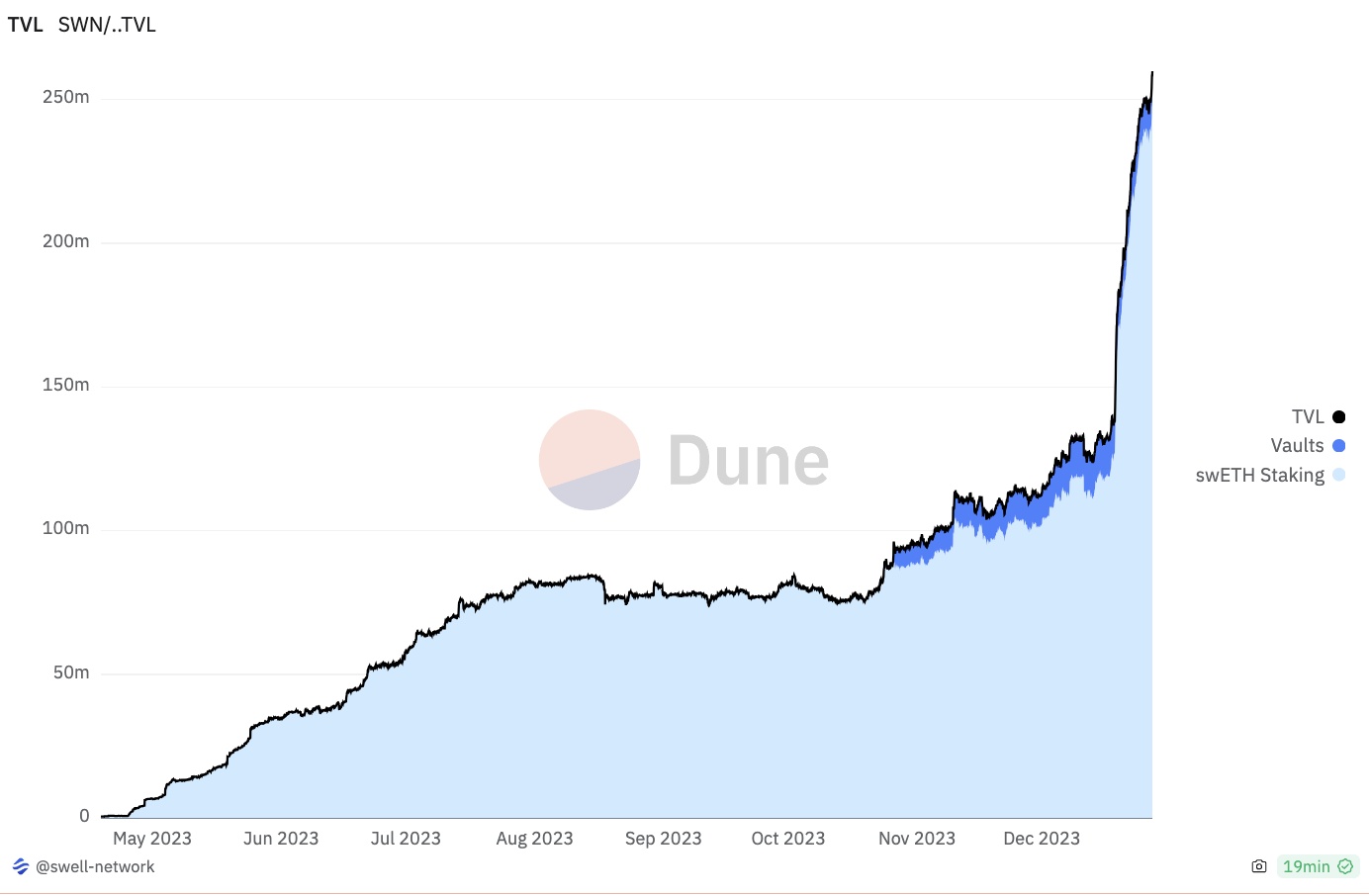

- Swell’s liquid staking protocol saw a major increase in inflows, reaching total value locked of 108,000 ether ($245 million).

- Swell is now the fourth largest liquid staking protocol, behind Lido, Rocket Pool, and Frax.

Liquid staking protocol Swell has seen its total value locked double this month to 108,000 ether worth about $245 million.

Since the start of December, Swell has recorded nearly $125 million in ETH deposits, elevating it to the fourth-largest liquid staking protocol. It currently ranks behind leading protocols such as Lido with 9 million ETH, Rocket Pool with 846,000 ETH, and Frax with 236,000 ETH, according to Dune data aggregated by Dragonfly analyst Hildobby.

The surge in Swell inflows coincides with its team announcing "Pearl" rewards in the form of points for users who mint its liquid staking token, swETH, and also "restake" it on the EigenLayer platform.

Since mid-December, when the reward program began, there has been notable activity, with users minting over 53,000 swETH worth more than $120 million. Most of this was subsequently deposited on EigenLayer.

EigenLayer allows users to deposit and re-stake ether from a variety of liquid staking tokens to secure third-party networks. It expanded its supported assets to include six additional liquid staking tokens including Swell's swETH, Stakewise's sETH, Stader's xETH, Origin's oETH, Ankr's ankrETH, and Wrapped Beacon Ether (wBETH). Among these new additions, Swell has emerged as one of the biggest beneficiaries in terms of asset inflows.

Swell's total value locked | Source: Swell (via Dune)

Despite documented risks with liquid staking, Swell's TVL surge shows that it continues to be a growing niche within the Ethereum ecosystem. Its popularity is largely attributed to simplifying the complexity associated with staking, particularly in terms of running validator nodes and allowing users to maintain control over their capital.

Swell users who stake their ETH receive a yield-bearing liquid staking token in return. The token not only holds value but also provides flexibility, as it can be retained or utilized within the broader DeFi ecosystem to generate additional yields.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.