Crypto market could face near-term correction as analyst says rate cut delay is still not priced in

Quick Take

- The cryptocurrency market is poised for a near-term downside correction because the Federal Reserve’s suggested rate cut delay has yet to be priced in, according to an analyst.

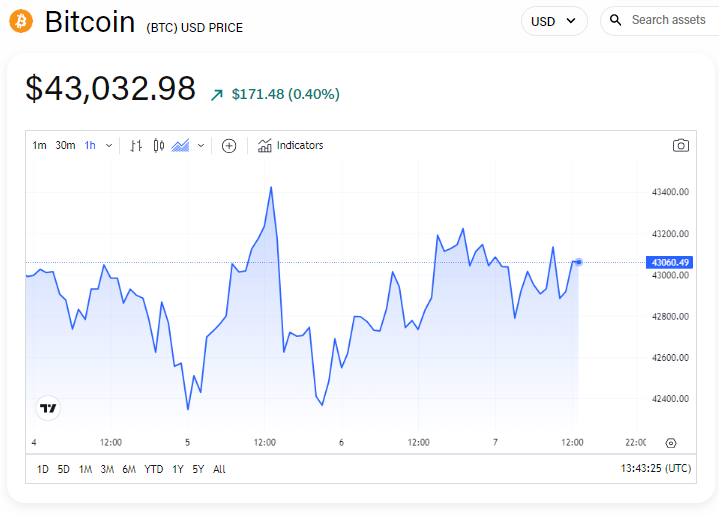

- Bitcoin traded flat over the last 24 hours, holding above the $43,000 mark.

The cryptocurrency market could experience a near-term downside correction, as suggestions the U.S. Federal Reserve will postpone a rate cut have yet to be priced in, according to an analyst.

Bitfinex Head of Derivatives Jag Kooner said "the market is currently pricing the Fed being more dovish than Federal Reserve Chair Powell’s statements would imply."

The Bifinex Head of Derivatives added that a lag in the market pricing in Powell's latest statements could result in a downside correction for bitcoin, alongside other cryptocurrencies and financial markets. "The cryptocurrency market could decline in the near-term if the market expectations for a rate cut continue to be high and the next FOMC meeting also results in a pause," Kooner told The Block.

Fed rules out rate cut in March

On Sunday, Federal Reserve Chair Jerome Powell ruled out an earlier rate cut in 2024, despite wider markets anticipating the commencement of the central bank's rate-cutting cycle in March.

When interviewed on CBS' 60 Minutes, Powell stated that a rate cut in March is "not likely" to happen. “We’ve said that we want to be more confident that inflation is moving down to 2%,” Powell added. “I think it’s not likely that this committee will reach that level of confidence in time for the March meeting, which is in seven weeks.”

Kooner added that Powell's signaling of a rate cut postponement "has potentially contributed to a risk-off sentiment in the market."

RELATED INDICES

Risk-off sentiment pervading the market

There are other lingering uncertainties in current market conditions that are contributing to this risk-off sentiment, according to BIT Mining Chief Economist Youwei Yang.

"The rate cut delay, less likely soft landing, as well as dotcom bubble type of patterns showing in AI stocks are worrying the markets turning into risk-off sentiment now, that could lead to a broad sell-off triggered by any new event such as CPI data," Yang told The Block.

According to Vertex Protocol Co-Founder Darius Tabai, there is still no definite clarity on when rate cuts will come into effect. "For now, it makes no sense to see huge moves in either direction given the levels of inflation and rates as central bankers tend to be slow moving in their analysis," Tabai told The Block.

The largest digital asset by market capitalization traded flat on Wednesday, changing hands for $43,032 at 8:45 a.m. ET, according to The Block's Price Page.

Bitcoin  BTC

+2.31%

has held above the $43,000 mark on Wednesday. Image: The Block.

BTC

+2.31%

has held above the $43,000 mark on Wednesday. Image: The Block.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.