Bitcoin price whipsaws around $60,000 while ETFs see record volumes: 'This is officially a craze'

Quick Take

- The price of bitcoin whipsawed around the $60,000 mark as daily volume for the nine new spot bitcoin ETFs broke a record for the second time this week.

- BlackRock’s spot bitcoin ETF also recorded its best day of capital inflows on Tuesday after taking in $520 million.

- Bitcoin’s volatile price movements in the perpetual futures markets resulted in significant losses across many crypto portfolios.

The rollercoaster ride isn't showing signs of slowing down.

While the price of bitcoin whipsawed around the $60,000 mark on Wednesday, daily volume for the nine new spot bitcoin ETFs took some market watchers by surprise when by midday they had already set another new record, besting Monday's record-setting day.

"Only halfway through trading day and New Nine bitcoin ETFs have already broken their all time daily volume record with $2.6 billion," Bloomberg Senior ETF analyst Eric Balchunas posted to X on Wednesday. "We got four bitcoin ETFs in Top 20. [BlackRock's] is #4 overall, it's gonna trade more today than in its first two weeks combined. This is officially a craze."

Meanwhile the price of bitcoin — quite possibly benefitting from the rising demand for the cryptocurrency as institutional buyers purchase bitcoin in earnest — briefly touched $64,000 on some exchanges on Wednesday before quickly retreating to the $60,000 mark, where it continued to hover much of the early part of the day. Bitcoin  BTC

+3.22%

was up by 6% on Wednesday and trading at $60,720 as of 2:50 p.m. ET, according to The Block's Price Page.

BTC

+3.22%

was up by 6% on Wednesday and trading at $60,720 as of 2:50 p.m. ET, according to The Block's Price Page.

Price of bitcoin. Image: The Block Price Page.

BlackRock's ETF leading the charge

On Monday, the nine new spot bitcoin ETFs set a new daily volume record when they registered a combined $2.4 billion in buying and selling activity. That performance bested the previous record set on Jan. 11, the day the new products officially launched. The nine new spot bitcoin ETFs exclude Grayscale's converted fund. BlackRock's bitcoin-based exchange-traded fund leads all other similar products including the other new products being offered by Fidelity, Bitwise, Ark 21Shares, Invesco, VanEck, Valkyrie, Franklin Templeton, and WisdomTree.

Including Grayscale's fund, all spot bitcoin ETFs also hit a new daily record on Wednesday with more than $6 billion trading, according to Bloomberg Intelligence ETF research analyst James Seyffart.

RELATED INDICES

BlackRock's spot bitcoin ETF, ticker symbol IBIT, recorded its best day of capital inflows on Tuesday after taking in $520 million, according to BitMex Research. At the end of last week BlackRock's fund had more than $6 billion in assets under management.

Balchunas, it appears, understands that the seemingly nonstop slew of spot bitcoin ETF coverage might feel like overkill to some, but he said its warranted given how well the products are performing. "I get that the coverage is relentless and prob annoying to some, but these numbers are absurd, highly rare stuff here," he posted Wednesday. "It would be like asking a scientist not to get obsessed with Haley's Comet or something."

Heavy liquidations in the futures markets

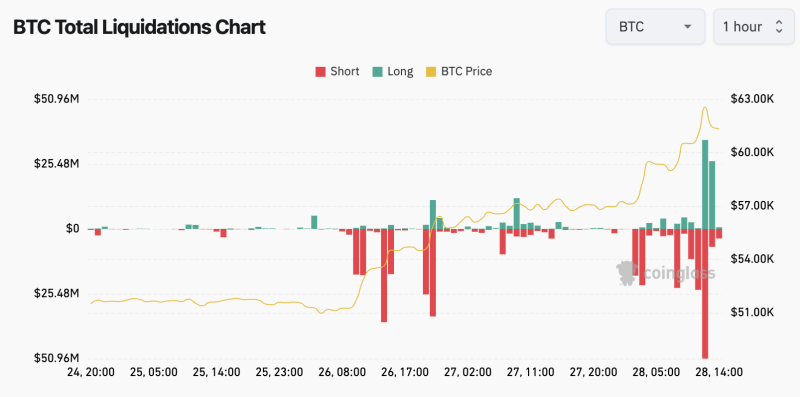

Bitcoin's volatile price movements in the perpetual futures markets resulted in significant losses across many crypto portfolios. During Asia trading hours on Wednesday, as prices surged past $57,000, short liquidations amounted to $40.47 million within two hours, based on Coinglass data. As New York traders began their day around 8:00 a.m. Eastern Time, with prices nearing $60,000, an additional $23 million in short liquidations took place.

(Source: Coinglass)

From 10:00 a.m. to approximately 12:15 p.m. ET, another wave in short positions, $86.74 million worth, was liquidated, helping to propel bitcoin's price to a peak of $64,100 on platforms like Coinbase. Soon after, it was the long position holders turn to face losses as the $64,000 level proved to be unsustainable. In the span of just one hour after noon, $59.52 million worth of long positions were liquidated.

Other cryptocurrencies also experienced significant liquidation of long positions. Between 12:30 and 12:45 p.m. ET, a total of $122.864 million in long positions, excluding Bitcoin, were liquidated, with ether futures accounting for just $15.8 million of this total.

In the end, a total of $697.04 million in positions—comprising $332.89 million in longs and $364.15 million in shorts—were liquidated within 24 hours as of 2:00 p.m. ET.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.