Bitcoin dips below $64,000 as stocks hit record highs

Quick Take

- Bitcoin dropped below $65,000, despite major stock indices hitting record highs fueled by rate-cut expectations.

- The bitcoin price correction over the past day led to the substantial liquidation of long positions on centralized exchanges.

The value of the largest cryptocurrency by market cap decreased by over 4% in the past 24 hours, trading at $63,990 at 8:46 a.m. ET.

Bitcoin has fallen by over 4% in the past 24 hours. Image: The Block.

Market volatility over the past day

The bitcoin price correction over the past day led to the substantial liquidation of long positions on centralized exchanges. This volatility resulted in the liquidation of more than $54 million in bitcoin positions, with the majority — over $40 million — being longs, according to CoinGlass data.

The second-largest crypto, ether, also experienced a 3.4% downturn over the past day — now at $3,417 at 8:46 a.m. ET. SOL, the native coin of the Solana network, was hit harder, sliding by over 8% in the same period, according to The Block’s Prices Page.

The overall crypto market experienced over $134 million in liquidated long positions in the last 24 hours, contributing to a total of $192 million in liquidations across various centralized exchanges, the data show. (Liquidations occur when a trader’s position is forcibly closed due to a lack of funds to cover losses. This happens when market movements are unfavorable to the trader’s position, leading to the depletion of their initial margin or collateral.)

RELATED INDICES

Declining bitcoin liquid supply

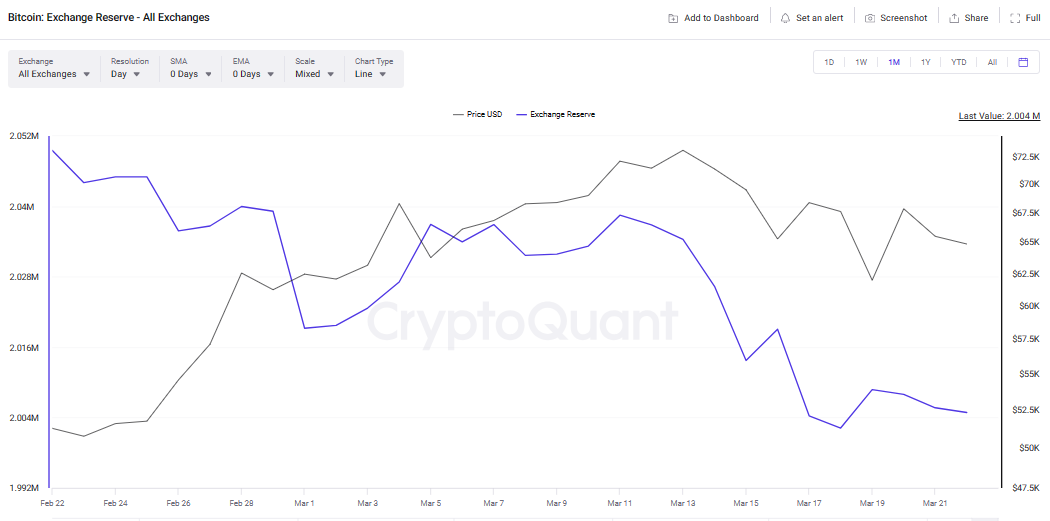

Bitcoin exchange reserves have fallen to a multi-week low, indicating an increase in investors removing their coins as part of a long-term holding strategy.

According to CryptoQuant data, in the past month, there has been an outflow of over 44,600 bitcoins, resulting in exchange reserves hitting a multi-week low of just over 2 million bitcoins.

The outflow of bitcoin from exchanges to cold storage has been a trend since the beginning of the year, possibly driven by the rise in the digital asset's price and spot bitcoin ETF inflows.

Bitcoin exchange reserves are falling. Image: CryptoQuant.

The GM 30 Index, representing a selection of the top 30 cryptocurrencies, has decreased by 3.98% to 141.78 in the past 24 hours.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.