Here are the top three cryptocurrency stories from last week

Quick Take

- Crypto lending business Genesis is facing possible bankruptcy after it took hits from Three Arrows Capital and now FTX.

- Binance announced a $1 billion recovery fund and MetaMask caused consternation with its new privacy policy.

As the FTX collapse continues to reverberate, knock-on effects are still being felt throughout the industry. Chief among them is DCG’s empire, with concerns that one of its flagship businesses, Genesis, could go bankrupt.

Binance has also reacted in its own way to the FTX meltdown, by setting up a $1 billion fund to help affected businesses.

On a separate note, MetaMask has come under fire for its data collection practices, with many crypto users now worried about their own privacy. MetaMask’s founder downplayed the impact.

Genesis in dire straits

Crypto lending business Genesis is facing possible bankruptcy after it took big hits from Three Arrows Capital and now FTX — all in the wake of the collapse of the cryptocurrency Luna earlier this year. Three Arrows cost it about $1 billion and FTX took it for $175 million.

Its parent company, DCG, which assumed the majority of the liabilities, is trying to sort out the mess. The company, which owns CoinDesk, Grayscale and Luna, has been trying to raise $1 billion to resolve the situation, according to reports. Yet it has been struggling to do so.

Despite this situation, DCG CEO Barry Silbert remained optimistic. He said DCG would emerge from the current environment stronger, citing its experience in previous crypto winters. For its part, Genesis said it has no imminent plans to file for bankruptcy.

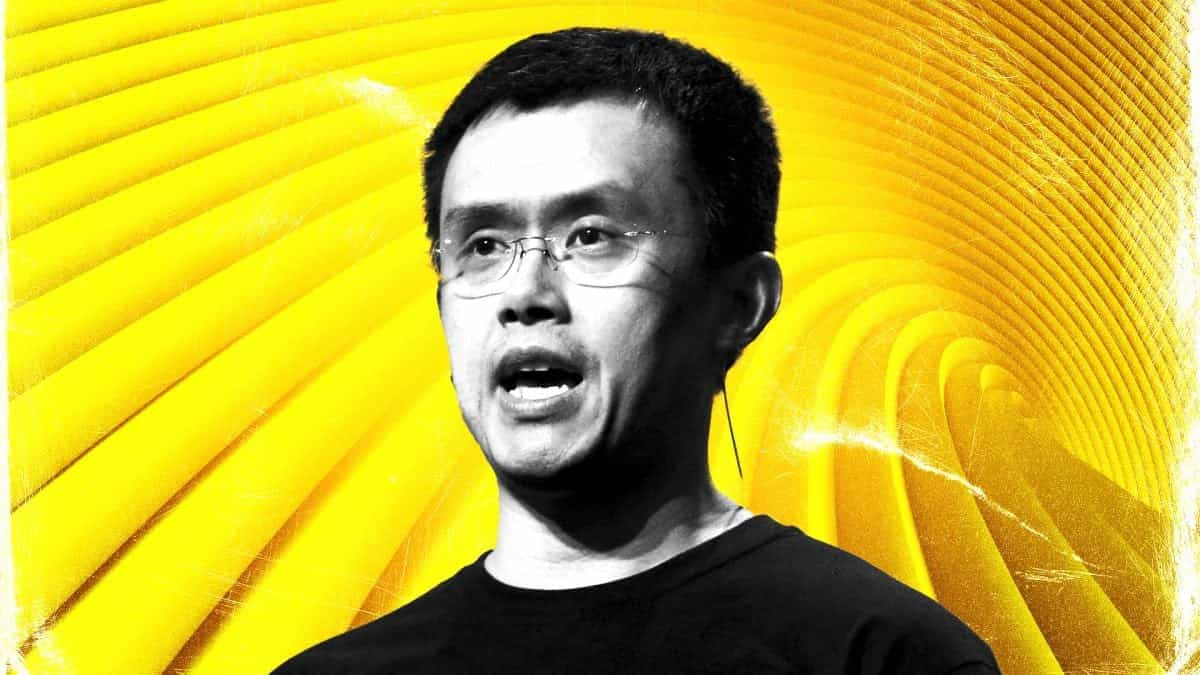

Binance flush with cash

While many crypto businesses are struggling with liquidity issues, Binance is determined to prove otherwise. Not only has it started providing more details on its assets — trying to prove that it holds all of its customer assets in the same tokens — but it has also created a $1 billion recovery fund for the industry.

The fund was announced last week to help mitigate the fallout stemming from FTX's collapse. It's expected to last for about six months and has already received more than 150 applications. Binance stressed that it's not an investment fund.

A number of big names in the crypto industry have signed on to contribute, including GSR, Jump Crypto and Polygon Ventures. Tron DAO and Justin Sun have indicated they would also like to contribute.

Binance provided on-chain evidence of these spare funds. While on-chain analysis showed it came out of the exchange’s own customer wallets, the exchange confirmed that the money was its own.

MetaMask under fire

Crypto wallet MetaMask has come under heavy criticism after its parent company ConsenSys said that the wallet sends a variety of on-chain and off-chain data to its sister company Infura — which is set as default.

Not only does Infura receive the wallet information of all wallets in that one MetaMask account — linking them together — but it also receives IP addresses, which could be used to locate individuals.

“When you use Infura as your default RPC provider in MetaMask, Infura will collect your IP address and your Ethereum wallet address when you send a transaction,” ConsenSys said.

Still, MetaMask Founder Dan Finlay said on Twitter that he understands MetaMask is not using IP addresses even if they are being temporarily stored. "I think we can get this fixed soon," he said.

Disclaimer: The former CEO and majority shareholder of The Block has disclosed a series of loans from former FTX and Alameda founder Sam Bankman-Fried.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.